Keep in mind that exchanging currency often comes with fees attached, which calculators typically don’t include. Since exchange rates fluctuate on a daily basis, using a calculator can ensure your math is accurate. When you’re ready to convert currency, using a currency conversion calculator is a smart way to estimate how much you’ll spend. Luckily, converting USD to CAD is pretty simple.

Us to cad exchange rate by date how to#

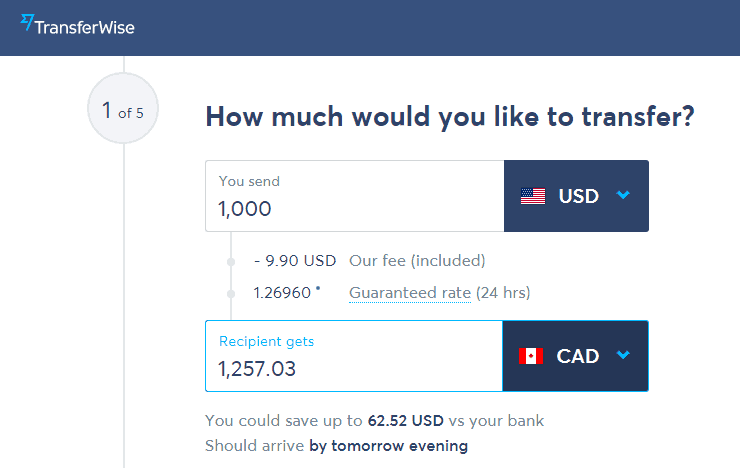

It's worth noting that while these tips can help you save on exchange rates, it's important to be aware that no single method is guaranteed to provide the best exchange rate in every situation, and it may require some research and comparison-shopping to find the best option for your specific needs.Via Wise website How to Convert U.S. Our real-time foreign transfer and travel money/cards comparison calculators make shopping around easy and help you calculate how much you can save. The exact potential savings depends on the currencies being exchanged and the amount you are transferring and if you are willing to shop around. Travel money and possibly over 5% to 6% when sending money. The transaction margin you end up being charged can be considerably reduced by around a few percent (of total amount being exchanged) for These fees is usually contained within the exchange rate margin (or difference to the mid-rate). However working against you are the fees all foreign exchange providers charge for providing their service. Generally speaking, if you are buying Canadian dollar with US dollar, then it's better for the USD/CAD exchange rate to be higher. The key is reducing excessive costs and fees Buy currency in advance: If you know that you will need foreign currency in the future, consider buying it in advance when the exchange rate is favorable.It also allows you to make payments or withdrawals in the local currency while avoiding high conversion fees.

Use a multi-currency account: Having a multi-currency account allows you to hold and transfer money in both USD and CAD at close to the interbank rate.Use a credit/debit or travel card that doesn't charge foreign transaction fees: Some credit cards charge additional fees for transactions made in a foreign currency, so it's important to check with your card issuer to see if they charge these fees and what their exchange rate is.

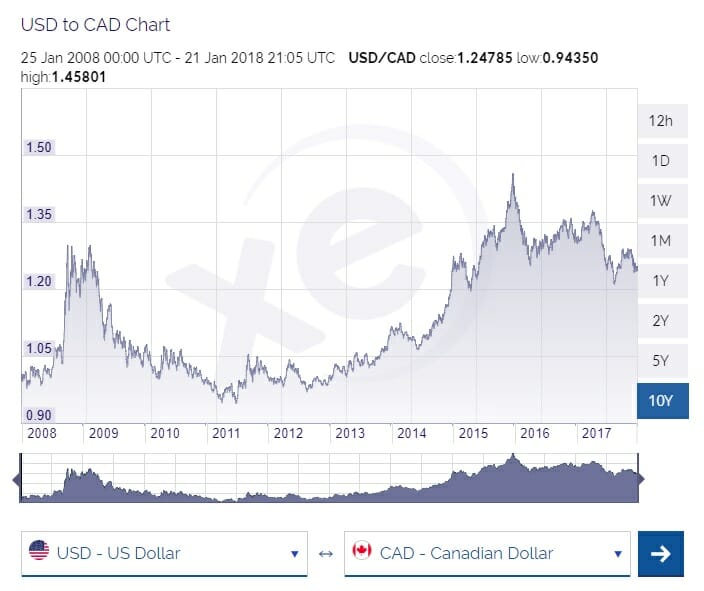

You can do this easily with our BER Smart Rate Tracker. Try to make your transactions when the exchange rate is in your favor. Timing is important: Keep an eye on the USD/CAD rate on currency markets, as exchange rates can fluctuate frequently.Shop around for the best USD/CAD exchange rate: Exchange rates can vary significantly between different currency exchange providers, so it's important to compare rates from different sources before making a conversion.There are several ways to save on exchange rates when converting US dollar to Canadian dollar: How to get a good USD to CAD exchange rate Note the limit with CIBC Global Money Transfer in a 24-hour period is C$30,000, if paying via credit-card C$15,000. While all banks in Canada charge this markup, the extra amount being charged is much higher than it would be with a global money transfer specialist. Our research shows that on average, CIBC profit margin for foreign exchange rates is somewhere between 4 - 8%, depending on the amount you're sending, where you're sending it to and which currency will be received. Our BER International Money Transfer partners tend to offer guaranteed transparency on all conversions. When you get a quote for your Global Money Transfer from CIBC on their website or in-app, you can also see the CIBC exchange rate, but it can be difficult to then calculate how much you are being charged.ĬIBC does not publish their exchange rates publicly which is frustrating. The CIBC Global Money Transfer service aims to allow customers to move money across borders just as easily as making a domestic wire transfer. One of Canada’s so-called “Big Five”, the Canadian Imperial Bank of Commerce was formed by the merger in 1961 of the Canadian Bank of Commerce and the Imperial Bank of Canada and is seen as a trusted banking institution.

0 kommentar(er)

0 kommentar(er)